Explore the investment potential of acquiring 20 Bitcoins now versus waiting for a future value of $200,000, analyzing market trends, future projections, and key factors influencing Bitcoin’s valuation.

In the ever-evolving landscape of cryptocurrency, Bitcoin remains a focal point for investors and financial analysts. The decision between acquiring 20 Bitcoins now or waiting for a future value of $200,000 is a compelling dilemma that underscores the transformative potential of cryptocurrency wealth.

Read more: Bitcoin Price Drops Below $93K Amid Market Volatility: What’s Behind the Slide?

Current Bitcoin Market Overview

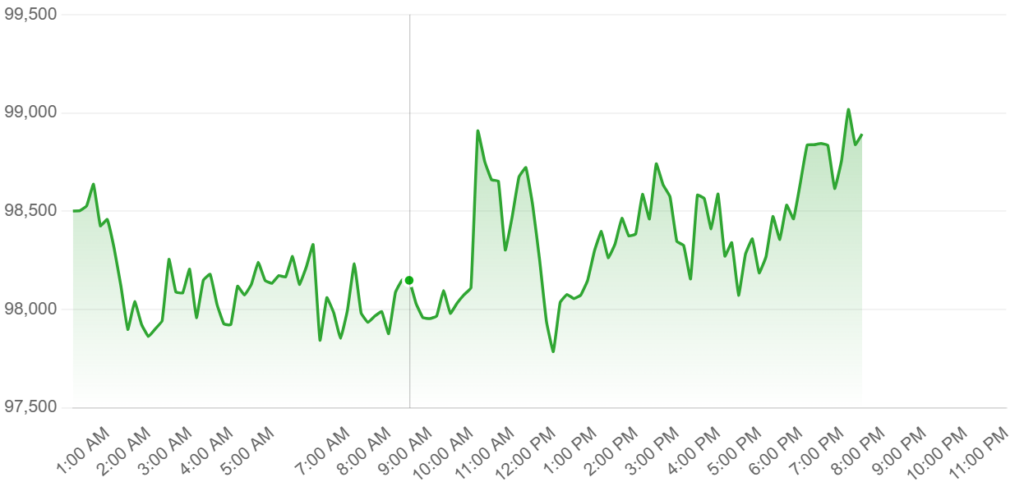

As of December 26, 2024, Bitcoin is trading at approximately $98,893 per coin. This valuation reflects a significant appreciation over the past year, influenced by factors such as increased institutional adoption, favorable regulatory developments, and macroeconomic trends.

The Value Proposition: 20 Bitcoins Now

Acquiring 20 Bitcoins at the current market price would require an investment of approximately $1,977,860. This substantial sum reflects Bitcoin’s status as a leading digital asset and its potential for future appreciation.

Future Projections: Bitcoin at $200,000

Analysts have varied projections for Bitcoin’s future value. Some forecasts suggest that Bitcoin could reach $200,000 or more in the coming years, driven by factors such as increased adoption, limited supply, and macroeconomic conditions. For instance, certain models predict Bitcoin attaining $1 million by 2025, indicating a bullish outlook on its long-term potential.

Comparative Analysis: Immediate Acquisition vs. Future Value

- Immediate Acquisition: Purchasing 20 Bitcoins now secures a significant stake in the cryptocurrency market. This approach benefits from potential appreciation and offers liquidity, allowing investors to capitalize on market movements.

- Future Value Realization: Waiting for Bitcoin to reach $200,000 per coin implies a belief in its continued growth. However, this strategy involves opportunity costs and the risk of missing out on intermediate gains.

Factors Influencing Bitcoin’s Future Value

- Institutional Adoption: The entry of institutional investors and the approval of Bitcoin ETFs have legitimized Bitcoin as an asset class, potentially driving demand and price appreciation.

- Regulatory Environment: Favorable regulatory developments, such as pro-crypto policies under certain administrations, can enhance market confidence and stimulate growth.

- Market Sentiment: Public perception and investor sentiment play crucial roles in Bitcoin’s valuation, with positive news and endorsements contributing to price increases.

Read more: Bitcoin Price Breaks $100,000: Is a Crash Coming in 2025?

Risks and Considerations

- Market Volatility: Bitcoin’s price is subject to significant fluctuations, which can impact investment value in the short term.

- Regulatory Uncertainty: Potential regulatory changes could affect Bitcoin’s legality and market dynamics, influencing its future value.

- Technological Risks: Advancements in technology or the emergence of superior digital assets could pose challenges to Bitcoin’s dominance.

The decision between acquiring 20 Bitcoins now or anticipating a future value of $200,000 involves careful consideration of current market conditions, future projections, and individual investment goals. While Bitcoin presents substantial growth potential, it is essential to conduct thorough research and assess risk tolerance before making investment decisions.